National Insurance

National Insurance (NI) in the UK is a contributory system that allows people to receive certain state benefits as long as they have made the required contributions. These benefits may include:

- Basic state pension.

- Additional state pension.

- New state pension.

- Contribution-based jobseeker’s allowance.

- Contribution-based employment and support allowance.

- Maternity allowance.

- Bereavement support payment.

NI is paid by people aged 16 or over, who have a NI number and their earnings are above a certain threshold.

Throughout their working life, each person has a NI number comprising letters and numbers which ensures their contributions are credited only to their name. The number can be found on their payslips, P60 forms, letters from HMRC, pensions and benefits, and in their personal tax account.

NI numbers are used by HM Revenue and Customs (HMRC), employers, the Department for Work and Pensions, local councils and so on for electoral registration purposes, student loans, pensions, ISAs and so on.

Contents |

[edit] Classes of National Insurance

There are a number of different types of NI depending on a person’s employment status, their earnings and whether they have any gaps in their National Insurance record:

- Class1 National Insurance is paid by people in employment earning above a threshold. The contributions are automatically deducted from wages by employers.

- Class 1A or 1B National Insurance are paid by employers directly on their employee’s expenses or benefits.

- Class 2 National Insurance is paid by self-employed people earning above a threshold. Those earning below the threshold can choose to pay voluntary contributions.

- Class 3 National Insurance are voluntary contributions that can be paid by individuals to fill or avoid gaps in their NI contributions record.

- Class 4 National Insurance is paid by the self-employed people earning above a threshold.

[edit] Applying for a National Insurance number

Individuals are normally sent their National Insurance number automatically in the three months before their 16th birthday as long as they live in the UK; and a parent has submitted a Child Benefit claim on their behalf.

Foreign nationals planning to work in the UK cannot do so until they have a NI number which will allow them to find employment, apply for a student loan or claim benefits.

[edit] Related articles on Designing Buildings Wiki

- Capital gains tax.

- Construction industry scheme.

- Construction recruitment agency.

- Employee.

- Hourly rate.

- Human resource management in construction.

- IR35.

- PAYE.

- Payroll companies.

- Tax relief.

- Umbrella companies.

- Tax.

- VAT.

[edit] External references

Featured articles and news

Editor's broadbrush view on forms of electrical heating in context.

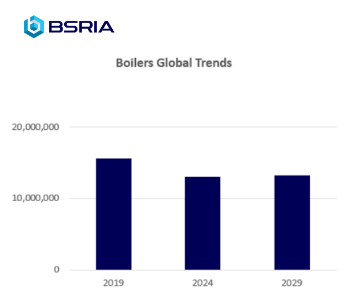

The pace of heating change; BSRIA market intelligence

Electric Dreams, Boiler Realities.

New President of ECA announced

Ruth Devine MBE becomes the 112th President of the Electrical Contractors Association.

New CIAT Professional Standards Competency Framework

Supercedes the 2019 Professional Standards Framework from 1 May 2025.

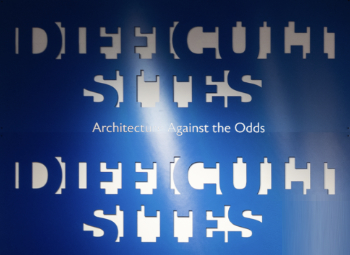

Difficult Sites: Architecture Against the Odds

Free exhibition at the RIBA Architecture Gallery until 31 May.

PPN 021: Payment Spot Checks in Public Sub-Contracts

Published following consultation and influence from ECA.

Designing Buildings reaches 20,000 articles

We take a look back at some of the stranger contributions.

Lessons learned from other industries.

The Buildings of the Malting Industry. Book review.

Conserving places with climate resilience in mind.

Combating burnout.

The 5 elements of seiri, seiton, seiso, seiketsu and shitsuke.

Shading for housing, a design guide

A look back at embedding a new culture of shading.

The Architectural Technology Awards

The AT Awards 2025 are open for entries!

ECA Blueprint for Electrification

The 'mosaic of interconnected challenges' and how to deliver the UK’s Transition to Clean Power.

Grenfell Tower Principal Contractor Award notice

Tower repair and maintenance contractor announced as demolition contractor.